MUTUAL CREDIT GUARANTEE SCHEME FOR MSMEs (MCGS-MSME) for Collateral Free Loans upto INR 100 Crores approved by Govt.

MUTUAL CREDIT GUARANTEE SCHEME FOR MSMEs (MCGS-MSME) for Collateral Free Loans upto INR 100 Crores approved by Govt.

Date : 31-01-2025

Posted By : Intellex Strategic Consulting Private Limited

MUTUAL CREDIT GUARANTEE SCHEME FOR MSMEs (MCGS-MSME) for Collateral Free Loans upto INR 100 Crores approved by Govt.

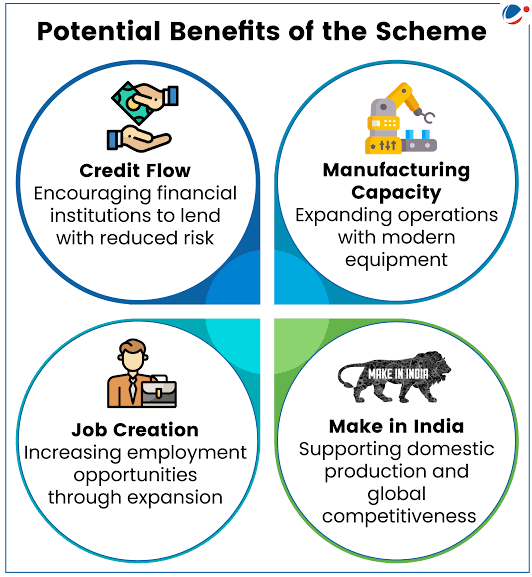

The aim of the scheme is to strengthen MSME manufacturing sector .

Government of India (GoI) has approved introduction of Mutual Credit Guarantee Scheme for MSMEs (MCGS- MSME) for providing 60% guarantee coverage by National Credit Guarantee Trustee Company Limited (NCGTC) to Member Lending Institutions (MLIs) for credit facility upto Rs.100 crore sanctioned to eligible MSMEs under MCGS-MSME for purchase of equipment/machinery.

SALIENT FEATURES OF THE SCHEME:

● Borrower should be an MSME with valid Udyam Registration Number

● Loan amount guaranteed shall not exceed Rs.100 crore

● Project Cost could be of higher amounts also

● Minimum cost of equipment / machinery is 75% of project cost

● Loan upto Rs.50 crore under the Scheme shall have repayment period of upto 8 years with upto 2 years moratorium period on principal instalments.

For loans above Rs.50 crore, higher repayment schedule and moratorium period on principal instalments can be considered.

● Upfront (initial) contribution of 5% of the loan amount shall be deposited at the time of application of guarantee cover

● Annual Guarantee Fee on loan under the Scheme shall be Nil during the year of sanction. During the next 3 years, it shall be 1.5% p.a. of loan outstanding as on March 31 of previous year. Thereafter, Annual Guarantee Fee shall be 1% p.a. of loan outstanding as on March 31 of previous year.

■ The Scheme will be applicable to all loans sanctioned under MCGS-MSME during the period of 4 years from the date of issue of operational guidelines of the scheme or till cumulative guarantee of Rs. 7 lakh crore are issued, whichever is earlier.

■ The scheme will facilitate collateral free loans by banks and financial institutions to MSMEs who are in need of debt capital for their expansion and growth.

■ MLIs - All Scheduled Commercial Banks (SCBs), Non-Banking Financial Companies (NBFCs) and All India Financial institutions (AIFIs), who register with NCGTC under the Scheme.

Sudheendra Kumar ( Mobile /WhatsApp: 91-9820088394)

Team- Intellex Strategic Consulting Private Limited

Follow us on LinkedIn:

https://www.linkedin.com/

https://www.linkedin.com/

https://www.linkedin.com/

https://www.linkedin.com/

Categories

- All Category

- Investment Opportunities

- Loans And Finance

- Business Opportunities

- Startup India

- Banking And Finance News

- Franchise & Dealership Network Development

- Real Estate (Residential, Commercial, Warehousing etc)

- Statutory Compliances & Taxation

- Hospitality Business Opportunity - Hotels, Resorts, Restaurants etc

- Jobs and Employment Opportunities

- Personal Finance

Latest Blogs

AU Small Finance Bank – Empowering Business Growth with Tailored Financial Solutions

Date : 09-11-2025

Posted By : Growmoreloans.com

Unsecured Business Loans up to ₹10 Crores under CGTMSE Scheme . No Collateral Required!

Date : 09-11-2025

Posted By : Growmoreloans.com

CGTMSE guaranteed Unsecured Working Capital Loans to MSMEs in India

Date : 02-11-2025

Posted By : Growmoreloans.com

Profectus Capital—Educational Institution Loans Made Simple

Date : 31-10-2025

Posted By : Growmoreloans.com

Credit Card Debt Trap: A Wake Up Call for Financial Discipline

Date : 29-10-2025

Posted By : Growmoreloans.com